Rethink 2020: Five trends to watch

“In these trying times, rather than fret about the future, it’s useful to take a step back and assess”

Recent head-spinning events – raging fires causing university closures in Australia; the UK exiting Europe; and most recently, a coronavirus outbreak bringing global mobility to a standstill – has the international education sector battered as if by a hurricane of headlines, writes Anna Esaki-Smith, Co-Founder and Managing Director of Education Rethink.

While none of these occurrences relates directly to education, they pose fundamental risks to an industry whose very core is rooted in the free movement of people. However, in these trying times, rather than fret about the future, it’s useful to take a step back and assess.

In Education Rethink’s latest report, Rethink 2020: Five Trends to Watch, we go back to basics by examining the foundational undercurrents driving student mobility towards the English-speaking world.

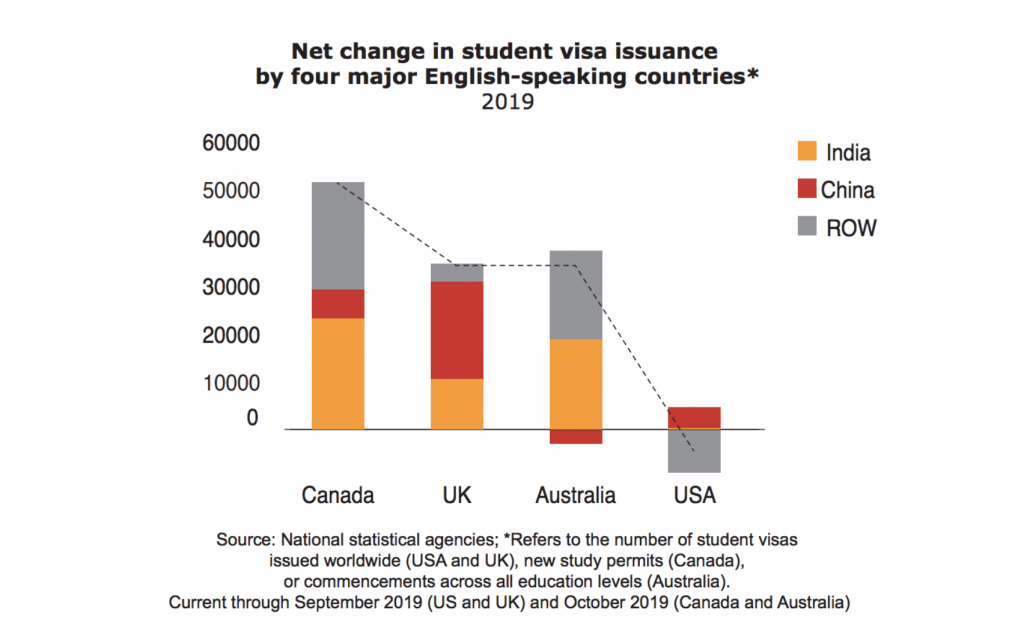

Consider that, in 2019, the total population of international students across the US, UK, Australia and Canada – grew by more than 115,000, according to the latest student visa issuance data.

But focusing on increasing numbers alone is not enough. Where are students coming from? And what are the factors driving those flows?

TREND #1: INDIA RISES WHILE CHINA DEPENDENCE PERSISTS

In 2019, Canada attracted more new international students than any other major English-speaking host destination country, and nearly half of this growth was due to one country: India. In fact, India overtook China as Canada’s largest overseas student market in 2017, making Canada unique among the four major English-speaking host destination countries (a phenomenon highlighted in our Rethink China report).

However, the major host countries – especially the UK — remain dependent on China for students, so the underlying tension is whether to prioritize diversification or growth.

TREND #2 A DIRECTIONLESS UNITED STATES CONTINUES TO FALTER

The United States is seeing flat or shrinking demand from nearly every corner of the globe. In the race to attract the next generation of international students, especially when compared with Canada.

Among the 15 international markets that grew the most in 2019, the United States has played a negligible role in all but China and Vietnam. In fact, the US saw its net issuance of student visas decline year-on-year in eight of these 15 growth markets.

TREND #3: AUSTRALIA LEANS INTO ITS VOCATIONAL SECTOR

While Australia has proven adept at developing new markets for international recruitment, it has also relied far more heavily on enrollments in its vocational sector to do so. In fact, new enrollments in Australia’s vocational education and training sector accounted for 65% of growth across all sectors in 2019[1].

This trend, dating back more than a decade, may be occurring at the expense of the higher education sector, which generally underscores a country’s ability to innovate and build a competitive workforce, as well as put a country on the global rankings map.

“While Australia has proven adept at developing new markets for international recruitment, it has also relied far more heavily on enrollments in its vocational sector to do so”

TREND #4: UK’S STUDENT VISA REFUSAL RATE RAPIDLY DECLINES’

“While Australia has proven adept at developing new markets for international recruitment, it has also relied far more heavily on enrollments in its vocational sector to do so”

The refusal rate among UK tier-4 visa applications has been on a steadily downward trajectory for the last decade, dropping from 25% of all applications in 2010 to less than 1.5% in 2019.

Much of this decline in the tier-4 refusal rate is attributable to the UK Home Office’s decision in 2014 to revoke the licenses of UK education institutions to sponsor international students if more than 10% of their students were refused student visas.

Conversely, in the United States the refusal rate of F-1 student visa applications was 22.8 % in 2018[2] – the last year for which data is available – more than ten times higher than the UK’s figure.

TREND #5: GLOBAL VOLATILITY INCREASINGLY IMPACTS RECRUITMENT

We can reasonably predict how an action triggered by, say, a pandemic – the cancellation of a number of standardised tests in China, for example – could prompt a tangible result, in this case, a possible decline in university applications from Chinese students.

What’s more difficult to assess are the longer-term implications of a shifting landscape, whether concerns over personal safety can be outweighed by a desire to increase employability via overseas study.

The outcomes of today’s ongoing challenges may take a while to fully manifest themselves but, at that point, who knows what we’ll be dealing with then?

About the author: Anna Esaki-Smith is Co-Founder and Managing Director of Education Rethink

[1] YTD through October 2019 data compared with YTD through October 2018 data.

[2] The last year for which data is available

Leave a Reply